san francisco gross receipts tax pay online

Over the next few years the City will phase in the Gross Receipts Tax and reduce the Payroll Expense Tax. 145 Medicare tax regardless of taxable income amount.

Usa California Pg E Pacific Gas And Electric Company Utility Bill Template In Word And Pdf Format Version 2 Bill Template Templates Words

Additionally the state levied 18centpergallon excise taxes on gasoline and diesel fuels.

. Keep employment tax records for at least 4 years after the date that the tax becomes due or is paid whichever is later. This online version of the San Francisco Municipal Code is current through Ordinance 69-22 File No. Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations.

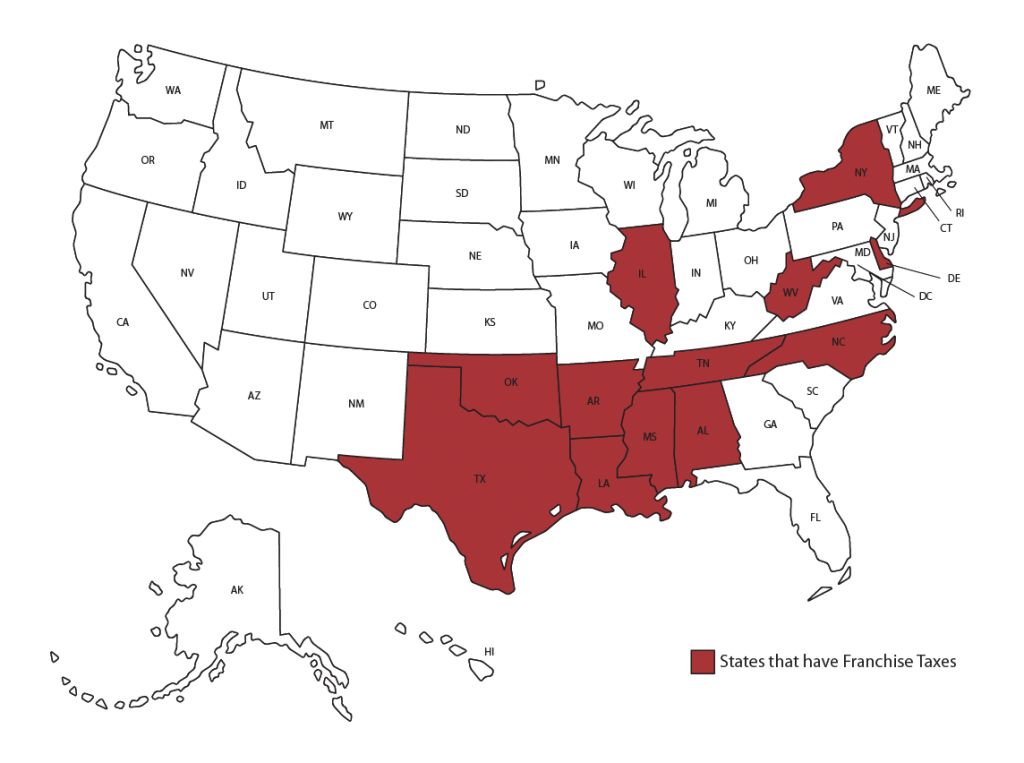

Residents of the state of Delaware pay taxes on their income. When a business fails to pay a franchise tax this may result in the business being disqualified from doing business in a particular state. This tax is assessed to these companies for the privilege of either doing business in the state or incorporating their business in that state.

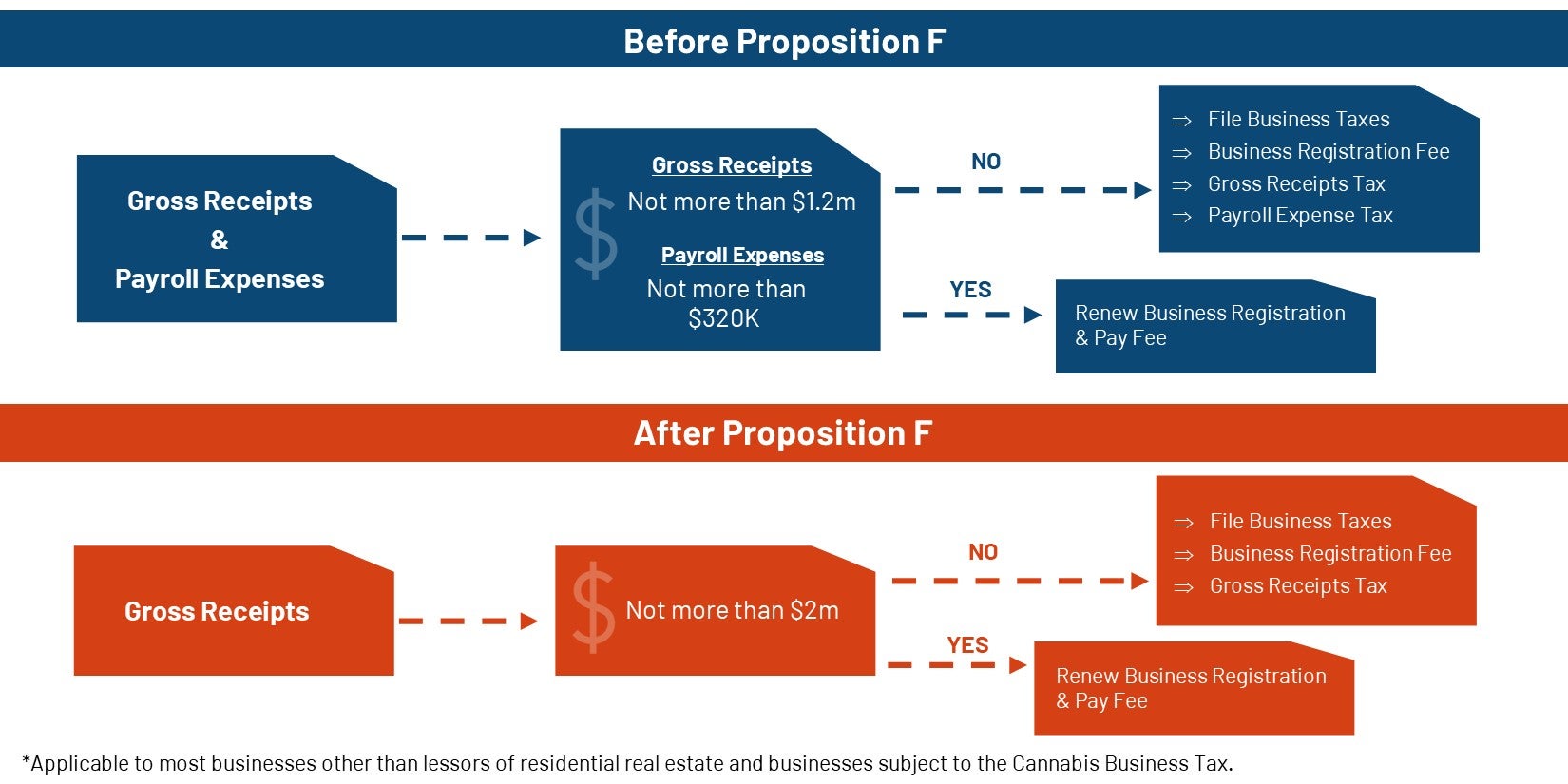

Which housed its Xoom business unit. Division I of the Transportation Code was last amended by Ordinance 118-21 File No. The new tax structure is based on gross estimated receipts instead of the flat rate currently used resulting in a smaller minimum tax number for businesses.

This document must be filed annually. So wait wheres the deduction. The Cannabis Business Tax was approved by San Francisco voters on November 6 2018 and becomes effective on January 1 2022.

In 2018 the standard tax percentage for self-employed individuals is 153 whereas a standard employee would pay 765 and their employer would also pay 765. The smallest minimum tax under the new. PayPal acquired Xoom which is focused on online money transfer.

The proceeds go toward housing and services. Gross receipts do not account for sales returns and allowances. Income franchise indirect taxes.

In 2010 the Legislature enacted the fuel tax swapa combination of sales tax and excise tax changes designed to give the state more flexibility in. PwCs State and Local Tax SALT practice helps navigate changing taxes and regulations. Income tax in the state of Delaware consists of six brackets.

In addition to the existing Gross Receipts Tax the Cannabis Business Tax imposes a gross receipts tax of 1 to 5 on the gross receipts from Cannabis Business Activities attributable to the City. If you have not received a renewal application from the CSLB within 45 days of the expiration date you can order a renewal online or by calling the CSLB at 1-800-321-CSLB 2752. 220090 approved April 28 2022 effective May 29 2022.

Businesses operating in San Francisco pay business taxes primarily based on gross receipts. Like income taxes typically franchise taxes are assessed annually. And an additional 09 Medicare tax will be applied to the following.

Credits incentives abandoned and unclaimed property. The City began making the transition to a Gross Receipts Tax from a Payroll Tax based on wages paid to employees in 2014. A tax term relating to the total business revenue from services provided that must be reported for the fiscal period.

As long as the information is visible and legible your scanned receipts and statements are acceptable as a. Different Sales Tax Rates Apply to Fuel. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts.

Residents of Delaware file an Individual Resident Tax Return also known as Form 200-01. The tax rates in those brackets range from a low of 22 percent to a high of 66 percent. Multiple sources say the payments giant is closing its San Francisco office on 425 Market St.

The San Diego Union-Tribune Editorial Board began surveying candidates in local county state and congressional races in March and publishing the following QAs in the newspaper and online in April. Prior to 2010 California applied the same sales tax rate to fuel as it did to other goods. 210566 approved August 4 2021 effective September 4 2021.

The move could be due to San Franciscos Prop C which levied a tax upon any San Francisco business that earns over 50 million in gross receipts. An acceptable renewal application must be received at CSLBs Headquarters Office prior to the expiration date of the license to avoid any unlicensed time.

Free Premium Templates Payroll Checks Payroll Template Small Business Ideas Startups

Sweden Citibank Statement Easy To Fill Template In Doc Format Fully Editable Statement Template Templates Bank Statement

Gross Receipts Tax And Other Indirect Pmba

San Francisco Gross Receipts Tax

Gross Receipts Tax And Payroll Expense Tax Sfgov

What Is Gross Receipts Tax Overview States With Grt More

Gross Receipts Tax And Other Indirect Pmba

Tax Services In Houston Tax Services Payroll Taxes Tax

What Are Gross Receipts Definition Uses More

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Usa San Francisco Chime Bank Statement Template In Word Format Statement Template Bank Statement Credit Card Statement

Nomersbiz Prepare A Tax Return Services In Usa Business Tax Tax Services Online Taxes

Quickbooks Online Vs Quickbooks Self Employed Quickbooks Online Quickbooks Self

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Annual Business Tax Returns 2021 Treasurer Tax Collector

Construction Billing Invoice Templates Construction Invoice Templates Construction Invoice Templates Invoice Template Invoice Template Word Invoice Layout

Time And Attendance Software For Employee Time Tracking Paycor Payroll Software Onboarding Process Scheduling Tools