colorado employer payroll tax calculator

However there is no wage cap for Medicare tax. WE ARE IN THE BUSINESS OF HELPING.

Payroll Tax What It Is How To Calculate It Bench Accounting

When to pay federal payroll taxes.

. This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis. Based on the data entered and the tax refund amount shown at WPRO-10 above we suggest you reduce your tax withholding to. Payrollguru app is a paid app for Windows Phone 7.

City or town state and ZIP code b Social security number. This solvency surcharge is a result of the UI Trust Funds level of solvency decreasing below a level that ensures the ability of the UI program to pay UI benefits. Notice to Employer of Injury Poster.

Why Gusto Payroll and more Payroll. A complete suite of workforce management services. Withheld payroll taxes are called trust fund taxes because the employer holds the employees money federal income taxes and the employee portion of Federal Insurance Contributions Act FICA taxes in trust until a federal tax deposit of that amount is made.

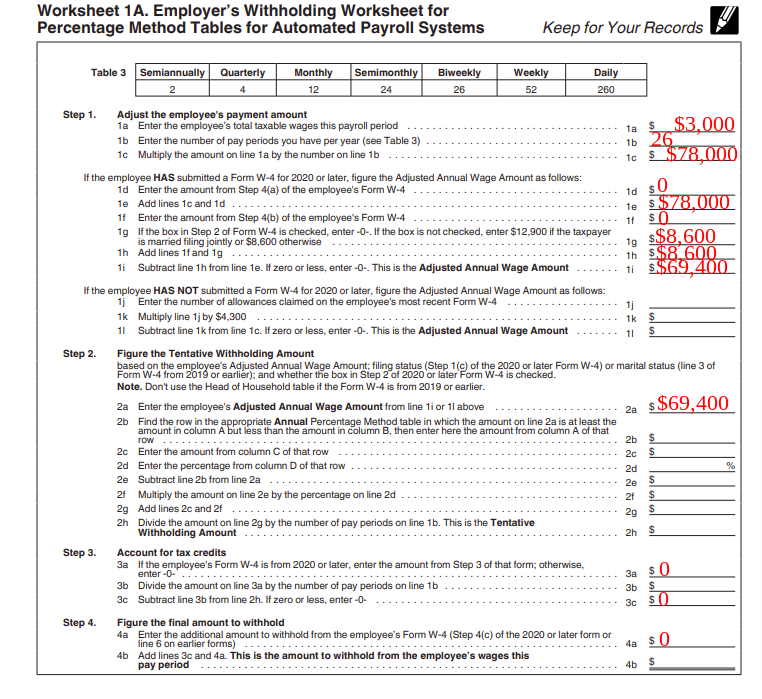

In addition notice is provided that benefits may be reduced if the injury results from use of a controlled substance. For example if the results from this calculator tell you to pay 1200 quarterly have your employer increase your withholding by 200 on your biweekly payroll. Switch to Colorado salary calculator.

Give Form W-4 to your employer. Independent contractors or self-employed individuals pay the full amount because they are. When the trust fund experiences a deficit employer rates are likely to increase in the following years.

Provides payroll human resources time tracking and benefits solutions for small-to-mid-sized companies. This poster must be displayed on the workplace premises and provides notice to the employee of the requirement to report all work-related injuries to the employer. For calendar year 2021 contributions may be eligible for a dollar-for-dollar deduction up to your 2021 Colorado taxable income.

Health benefits automatic savings 401ks and more. A complete suite of workforce management services. Both the employee and employer contribute 145 of the employees pay for Medicare.

Whether a person is an employee or an independent contractor a certain percentage of gross income will go towards FICA. Because most self-employed people do not receive paychecks they are often required to pay the self-employment tax on April 15th along with their regular income tax. Last name Address.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator. Enter Personal Information a First name and middle initial.

In accordance with SB20-207 the solvency surcharge is suspended for the year 2022 but will go into effect in the year 2023. In the case of employees they pay half of it and their employer pays the other half. Offer letters checklists software setup and more.

WPRO-12 In addition to your current IRS tax withholding which is most likely based on your latest W-4 and based on your entries we suggest you withhold this additional tax amount in order to balance or reduce the taxes owed with your 2022 Tax Return. Use this payroll tax calculator to see how adding new employees will affect your payroll taxes. Search this site Careers.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Tick the appropriate box. An employer is required to withhold federal income and payroll taxes from its employees wages and pay them to the IRS.

Self-employed individuals must pay both the employee and employer halves of the payroll tax which is commonly known as the self-employment tax. The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the. This results in the same amount of money being set aside without you having to do anything.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Your withholding is subject to review by the IRS. To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete inaccurate or inconsistent information supplied by you positions taken by you your choice not to claim a deduction or credit conflicting tax laws or changes in.

Beginning January 1 2022 the deductions will be limited to 20000 per taxpayer per Beneficiary for. The Payroll Tax also known as the. Switch to Colorado hourly calculator.

Its developed for business owners payroll specialist and payroll gurus that need to calculate exact payroll amounts including net pay take home amount and payroll taxes that include federal withholding medicare social security state income tax state unemployment and state disability withholding where applicable. Automatic deductions and filings direct deposits W-2s and 1099s. All employee wages are subject to the 145 tax.

Details of the personal income tax rates used in the 2022 Georgia State Calculator are published below the calculator this includes historical tax years which are supported by the Georgia State Salary Calculator. Depending on how much tax you owe you may have to pay your payroll taxes annually quarterly monthly or semi. Skip to main content.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. For Colorado taxpayers contributions to ANY CollegeInvest savings account are eligible for a deduction from your Colorado state income tax return¹. Does your name match.

Also known as payroll tax FICA refers to Social Security tax and Medicare tax.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

How To Calculate Payroll Taxes Methods Examples More

Payroll Records What To Keep How Long To Keep Them

Payroll Tax Calculator For Employers Gusto

How To Do Small Business Payroll Taxes Without A Tool

What Are State Payroll Taxes Payroll Taxes By State 2022

Payroll Tax What It Is How To Calculate It Bench Accounting

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Ems Core Portal Employee Engagement Payroll Software Payroll

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

What Are Employer Taxes And Employee Taxes Gusto

Employer Payroll Tax Calculator How To Calculate Withholding Tax

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes Methods Examples More

2022 Federal State Payroll Tax Rates For Employers

Employer Payroll Tax Calculator Incfile Com

How To Calculate Payroll Taxes Futa Sui And More Surepayroll